The Financial Impact of Losses

Measuring the financial impact of a loss cannot be underestimated by motor carriers, especially those with narrow profit margins. Typically in the trucking industry, each motor carrier relies on the loss runs provided by the insurer to gauge the severity of claims, but these numbers do not paint a complete picture of the loss impact on operations or the company’s bottom line.

Losses can be broken down into direct costs and indirect costs. To illustrate this, try to imagine an iceberg. The tip of the iceberg represents the direct costs associated with a loss because they are easier to see or predict; they include paying your insurance deductible, renting a piece of equipment, or paying to tow a damaged vehicle. Indirect costs, however, are hidden under the water because they are harder to quantify. They can also be larger than those expenses that are visible to the eye. Indirect costs can include lost productivity, training expenses to replace an injured worker, or damage to the company’s reputation due to bad public press.

The National Safety Council (NSC) estimates that indirect costs average $2.12 for every $1.00 of direct costs.1 Motor carriers simply cannot afford to write these expenses off as the cost of doing business because indirect costs are typically not budgeted. So, where will the money come from to pay for these losses? To maintain the company’s current profit margin, a motor carrier will need to either generate additional revenue or cut expenses to offset the loss and maintain its current level of profitability.

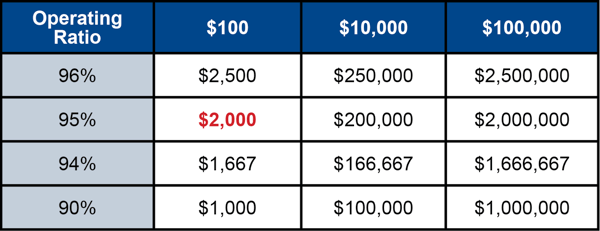

A Loss Revenue Matrix (Figure 1) can help you calculate the extra money needed to pay for an unbudgeted loss without sacrificing profit margin or cutting expenses like jobs or preventive maintenance. To calculate loss revenue, divide the cost of a loss by your profit margin. For example, suppose your company has a 95% operating ratio, which means you have a 5% profit margin. Now, say you have a $100 loss. The Loss Revenue Matrix shows that it will take an additional $2,000 in extra revenue (loss revenue) to pay for that loss without sacrificing profits.

Figure 1

The easiest way to avoid losses is to not have them in the first place. That is why investing in safety makes good financial sense. An NSC survey of Chief Financial Officers (CFO) found that “Over 60% of CFOs reported that each $1 invested in injury prevention returned $2 or more, and over 40% said productivity was the greatest benefit of an effective workplace safety program.”1 Learn from their experience and start giving safety a seat at the table when analyzing the financial impact of losses.

1National Safety Council (2013).

Call to Action

-

Use the Loss Revenue Matrix to calculate the loss revenue needed to pay for losses.

-

Track the frequency and severity of all vehicle crashes and work-related injuries and illnesses.

-

Include losses and corrective actions in department meetings.

-

Hold each department and employee accountable for safety performance.

Note: These lists are not intended to be all-inclusive.

The information in this article is provided as a courtesy of Great West Casualty Company and is part of the Value-Driven® Company program. Value-Driven Company was created to help educate and inform insureds so they can make better decisions, build a culture that values safety, and manage risk more effectively. To see what additional resources Great West Casualty Company can provide for its insureds, please contact your safety representative, or click below to find an agent.

© Great West Casualty Company 2019. The material in this publication is the property of Great West Casualty Company unless otherwise noted and may not be reproduced without its written consent by any person other than a current insured of Great West Casualty Company for business purposes. Insured should attribute use as follows: “© Great West Casualty Company 2019. Used with permission by Great West Casualty Company.”

This material is intended to be a broad overview of the subject matter and is provided for informational purposes only. Great West Casualty Company does not provide legal advice to its insureds, nor does it advise insureds on employment-related issues. Therefore, the subject matter is not intended to serve as legal or employment advice for any issue(s) that may arise in the operations of its insureds. Legal advice should always be sought from the insured’s legal counsel. Great West Casualty Company shall have neither liability nor responsibility to any person or entity with respect to any loss, action, or inaction alleged to be caused directly or indirectly as a result of the information contained herein.